Hi friends,

Happy Monday! The latest MacroVisor Dashboard is now available, with updates on a variety of asset classes around the world.

Announcement

In case you missed our recent Global Outlook for Q2 2024, here it is on our YouTube. We welcome your feedback and questions!

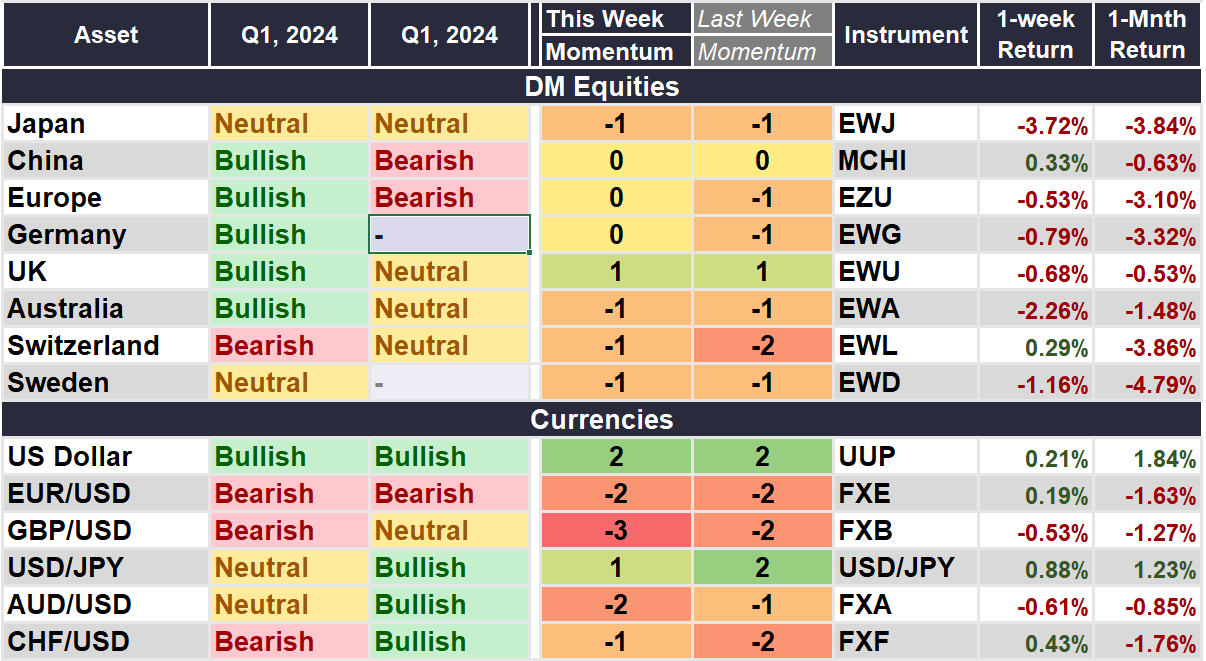

Here’s how the MacroVisor Dashboard displays our analysis:

Asset Name

Macro: This Quarter’s Macro Score

Macro: Previous Quarter’s Macro Score

Momentum: This Week’s Momentum Score

Momentum: Previous Week’s Momentum Score

Trading Instrument

1-Week Return

1-Month Return

Please make sure to also follow our Breakfast Bites articles where we report on relevant data to keep you updated alongside our weekly dashboard.

There is a key at the bottom of this post that tells you what we’ve considered when putting together this dashboard.

Scoring

3 is our highest positive momentum score, when everything suggests strong upward momentum that is likely to continue. We are more aggressive in accumulating during a score this high.

2 is our second highest positive momentum score, where buyers are in favor and we are likely to continue to build into positions if we are just starting them.

1 is our lowest positive momentum score, where buyers still enjoy a tactical advantage, but our conviction is not as high as momentum is not as strong and risks may exist.

0 is our neutral momentum score, where we would want to neither have longs or shorts in the short-term.

-1 is our lowest conviction negative momentum score, where we could start building a short position or exiting a long we held previously, but where we would not be aggressive.

-2 is our second-highest conviction negative momentum score, where we would be looking at building short positions or fully exiting longs.

-3 is our highest conviction negative momentum score, where we would be interested in more aggressive short positioning.

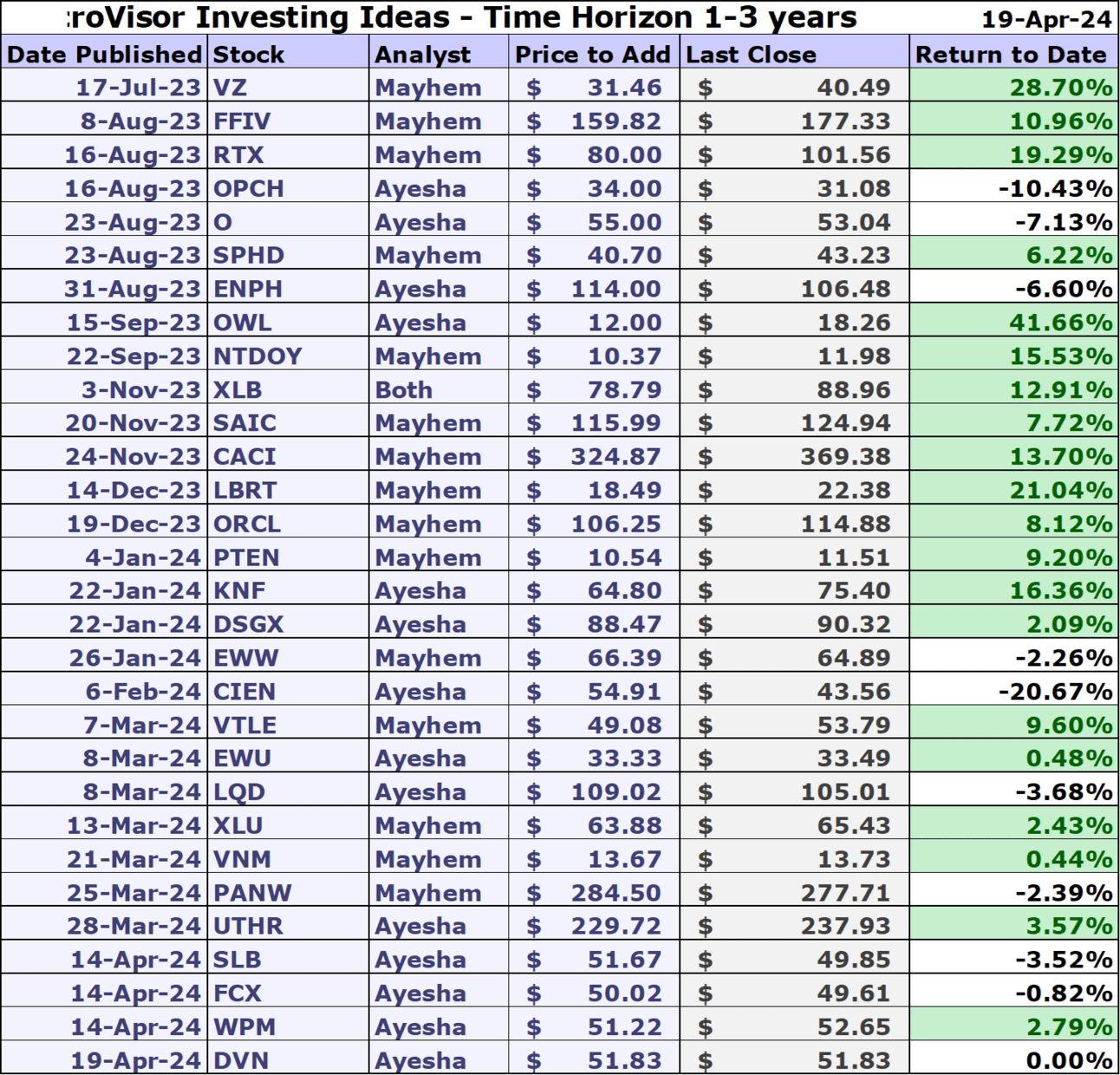

The MacroVisor Investing Portfolio

Our Notes for the Week Ahead

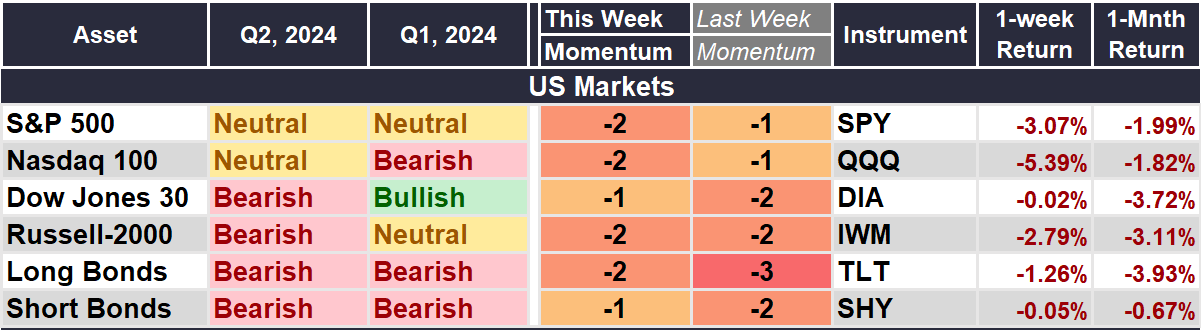

United States

S&P 500, NASDAQ 100, Dow Jones 30, Russell 2000

Last week marked a third straight week of losses in the S&P 500, which continues to show signs of negative momentum giving sellers the upper hand.

The NASDAQ has a similar negative view, albeit worse technicals after last week’s accelerated slide lower vs the S&P 500. The path of least resistance likely remains lower here.

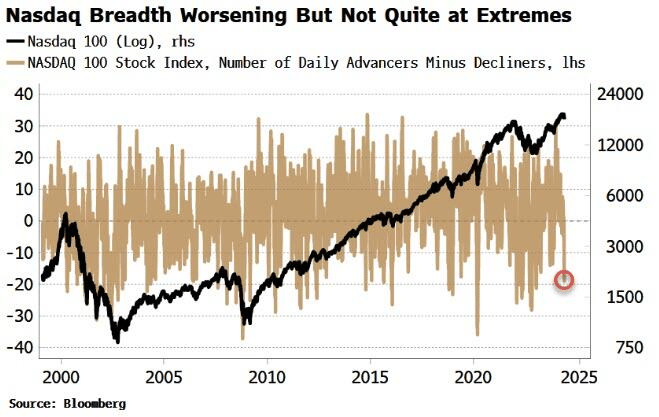

We’ve yet to see extremes that suggest near-term exhaustion in multiple measures, including breadth. That tells us that we may not yet be through the worst of the downside pressure over the near to intermediate-term.

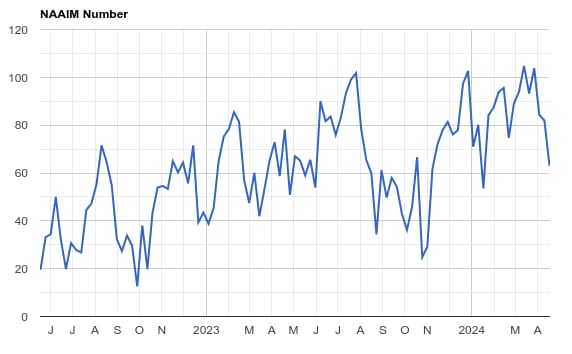

Positioning has lightened up considerably, but remains above its October-November lows of 2023 that marked an important turning point for the market after a corrective selling period.

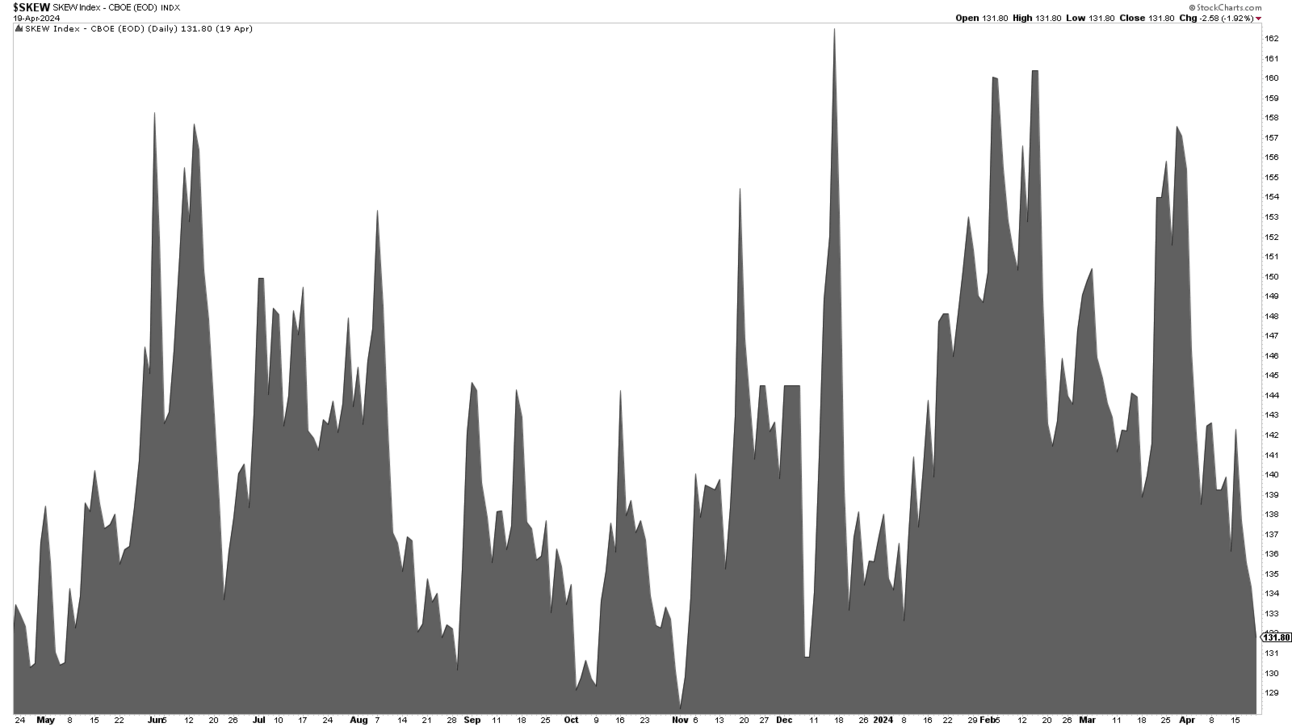

We also saw skew drop last week following options expiration, despite this week being full of event volatility catalysts that would suggest hedging would be an important consideration — unless one intended to distribute longs.

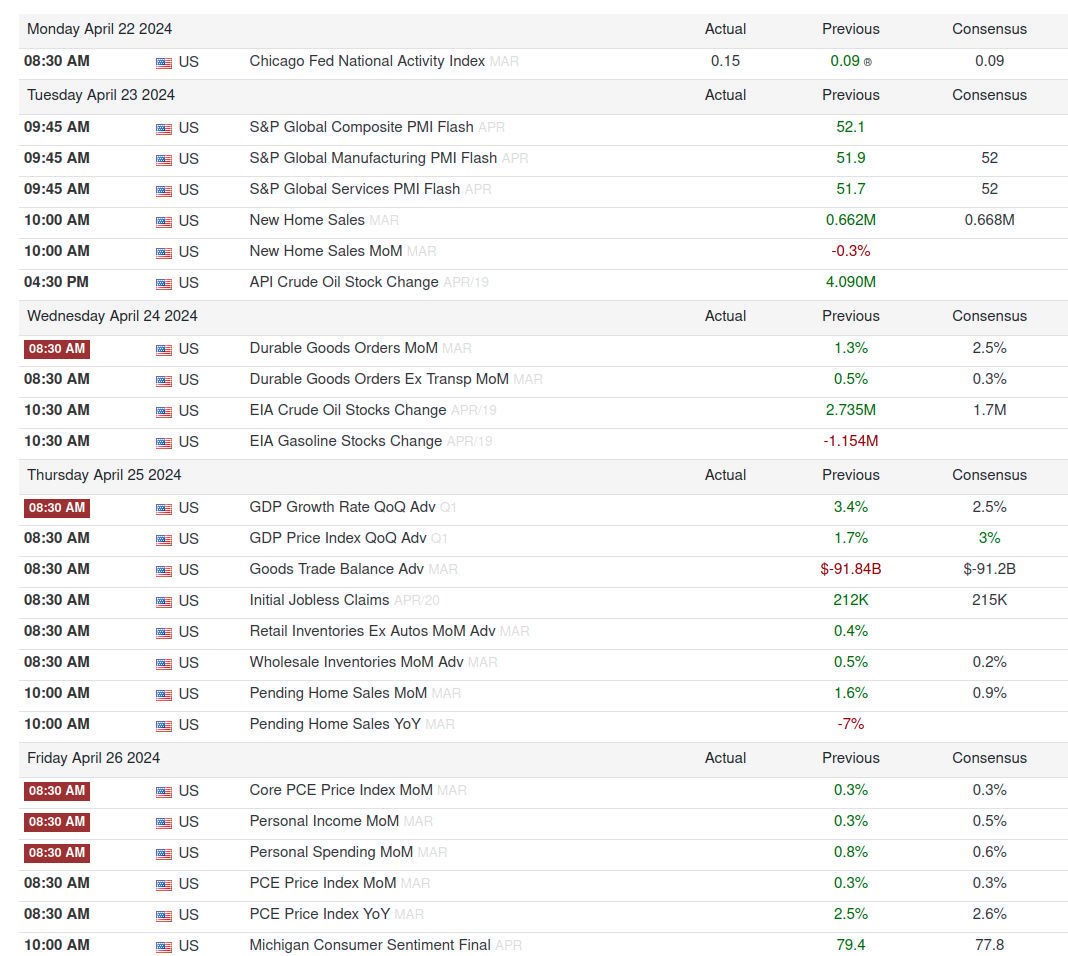

Key events include Durable Goods on Wednesday, GDP on Thursday and PCE on Friday. Any meaningful upside surprises could put further upside pressure on rates and downside pressure on equities. The opposite could be true of downside surprises as well.

Chart: Trading Economics

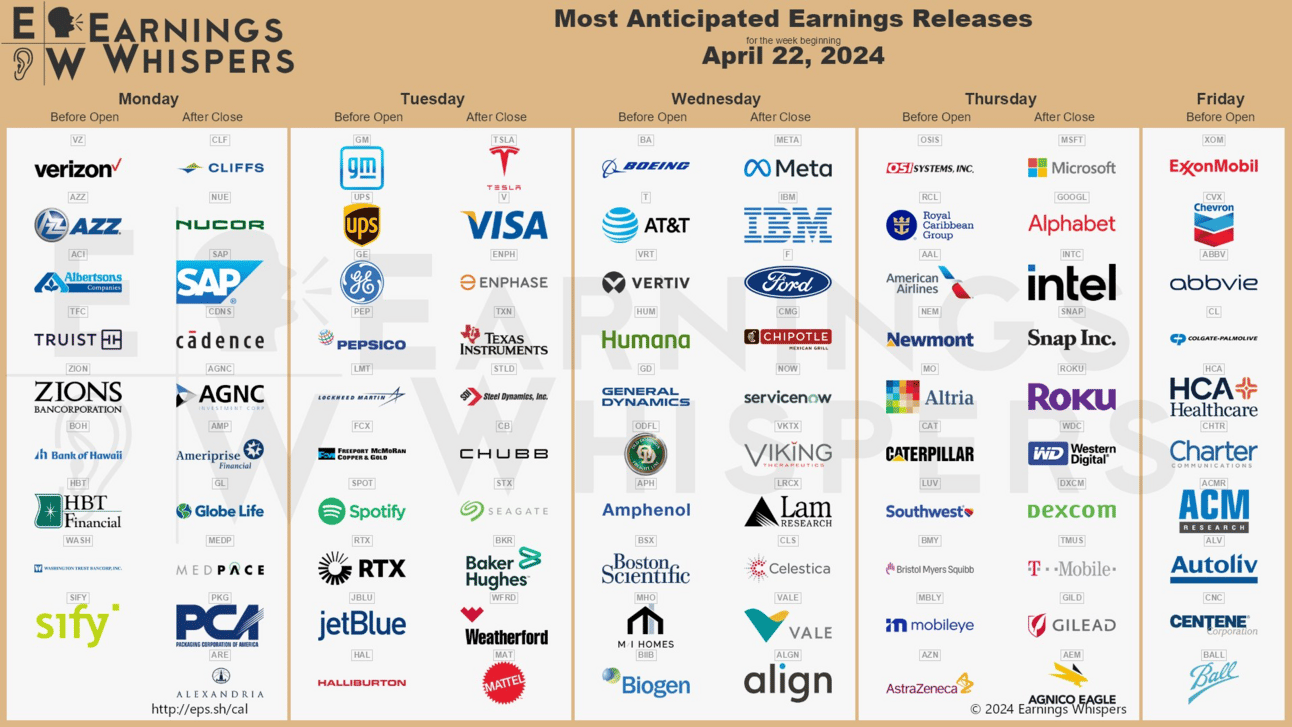

In terms of earnings, about 42% of the S&P 500 reports earnings this week, which means we have a lot of individual, industry and sector catalysts as well which could provide the market with additional reasons to move in a big way in either direction.

Book depth also remains low, meaning it takes less volume to move the market and we’re more likely to see choppy conditions.

Overall, we still believe that pops could continue to provide opportunities to fade the market, and that the path of least resistance is lower.

Our view could change in this regard if we see encouraging earnings, guidance and inflation data this week.

The Dollar, Long, and Short Duration Treasuries

Downside momentum in long bonds is fading, but the path of least resistance still remains lower based on the prevailing downtrend. GDP and PCE data could have an outsized impact on long-end rates should it come in meaningfully stronger or weaker than expected.

Downside momentum in the 2-year note is stabilizing to some degree, but the path of least resistance appears lower. Though that could change given everything happening this week.

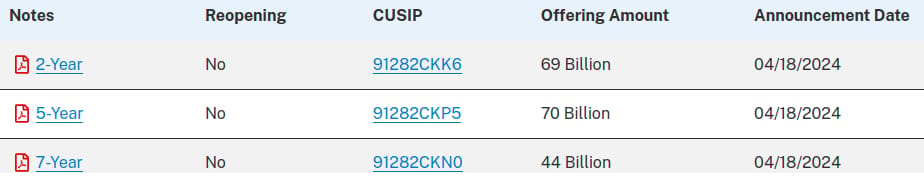

One big consideration is that there are $183B of 2s, 5s and 7s available in this week’s Treasury auctions, set to kick off tomorrow. This could also provide a catalyst for rates to move depending on auction results. Watching whether there is a tail (or an auction high rate that exceeds the pre-auction interest rate) is key to see whether demand is disappointing.

Source: US Treasury Department

Developed Markets

Japan & USD/JPY

The Bank of Japan meeting is this week – on Friday morning in Asia, late Thursday for the US. This meeting will be accompanied by the Economic Outlook and there’s some discussion that the BoJ is likely to lower their forecast for inflation. That would give the market a sign that they are turning more hawkish on rate policy. However, Governor Ueda came out today and said that condition would likely continue to remain easy. We may see some strengthening in the Yen after this meeting but, we’re not seeing much positive momentum on equities as a whole, at least not as expressed by the EWJ.

China

China left its loan prime rates unchanged. The markets are projecting cuts this quarter, and we may see that later, perhaps in June. For now, momentum remains neutral. We’re not seeing enough bullishness in equities in the short term but, if the current momentum continues, we may turn positive next week.

Europe & EUR/USD and Germany

European equities continue to see pressure with US stocks selling off as well. This is the busiest week for European earnings as well with 29% of the Stoxx 600 reporting, including major companies such as SAP reporting today. We’re seeing momentum improve slightly but remain neutral. The EUR however, continues to see negative momentum with the stronger dollar and the ECB’s rate cut being confirmed for June, no matter what.

UK & GBP/USD

UK equities continue to signal bullish momentum here. UK data came in mixed last week – we saw wage growth decline, unemployment increase, and GDP come in flat. Inflation numbers were a mixed picture coming in lower at the headline level but higher at the core level. Overall, the numbers were still higher than what the BoE wanted to see. However, BoE members have been openly discussing a rate cut sooner rather than later, and the market is now pricing in the first cut for June. While we still think the cut will come on 01 Aug, when we stack that against the Fed, which is now expected to cut in September, we’re seeing pressure on the GBP and bullish equities.

Australia & AUD/USD

Australian equities are still signaling negative momentum. There’s no change to the view.

Switzerland & CHF/USD

Momentum is looking less bearish for Swiss equities. After weeks of selling, we’re probably due for a bounce.

Sweden

Inflation numbers came in lower but, energy is a major component. The Riksbank governors have been talking about risks that could lead to inflation higher and remain cautious. The market is still pricing in the first cut for May but, with the narrative coming out of the Central Bank here, we’re likely to see the first cut pushed to June. This confusion is weighing on equities.

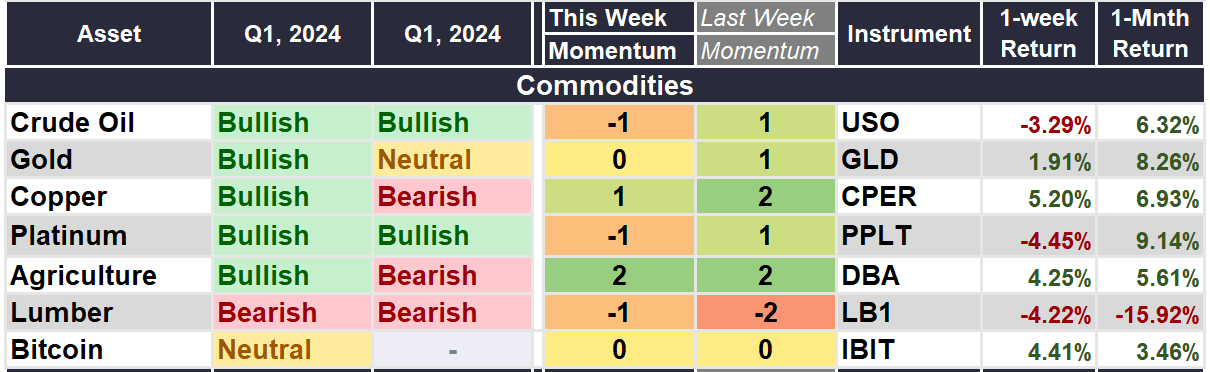

Commodities

Crude Oil

WTIC remains in a positive trend, but we are seeing corrective pressure. We believe that the CL contract would be a buy around $80.56. We also find this period of crude weakness to be an attractive time to add to or initiate energy longs in high quality stocks, like DVN, CVX, XOM, FANG, LBRT, VTLE, XLE and XOP.

Gold

The precious metal’s positive momentum is fading after corrective selling pressure today, but it remains in an overall intermediate-term uptrend. We would be interested in buying some additional gold exposure at $2,190. We also believe that could be a decent time to add to AEM, RGLD, NEM, and WPM.

Copper

After a powerful move last week, copper is consolidating some of those gains to start this week. We remain constructive on the industrial metal, and especially its miners, like FCX and SCCO. We also like COPX as a diversified long copper miner play. We would add to these positions on pullbacks.

Platinum

After nearly hitting our price objective on the nose of $1,022 last week, platinum reversed lower and is back to its intermediate uptrend channel line. We believe that platinum is attractive here to accumulate longs again. But, building a starter position that a reversion to the lower trend channel line would allow further accumulation into should we see that play out.

Agriculture

It doesn’t seem like anything can stop ag from moving higher, and now we’re seeing soy, corn, wheat and oats picking up as well as sugar, even as cocoa is becoming much more volatile. We believe that DBA can continue to move higher over the intermediate term, but that we may see some near-term consolidation as agricultural leadership is seeing a potential rotation into grains and other softs.

Lumber

Lumber fell below the area of support we identified last week and now is seeing a bit of a bid, trading at $515, above our lower support band. We think we could see some consolidation here after a rather aggressive sell-off, but the path of least resistance likely remains lower over the intermediate term as new home building slows with rising rates.

Bitcoin

The halving has happened, and it was overall a bit of a non-event with anticipatory buying front running the event itself. We did see renewed selling pressure last week, but bitcoin rebounded nicely as risk appetite remains rather robust. At this point momentum is overall neutral and we expect volatility to continue to be a theme in the space.

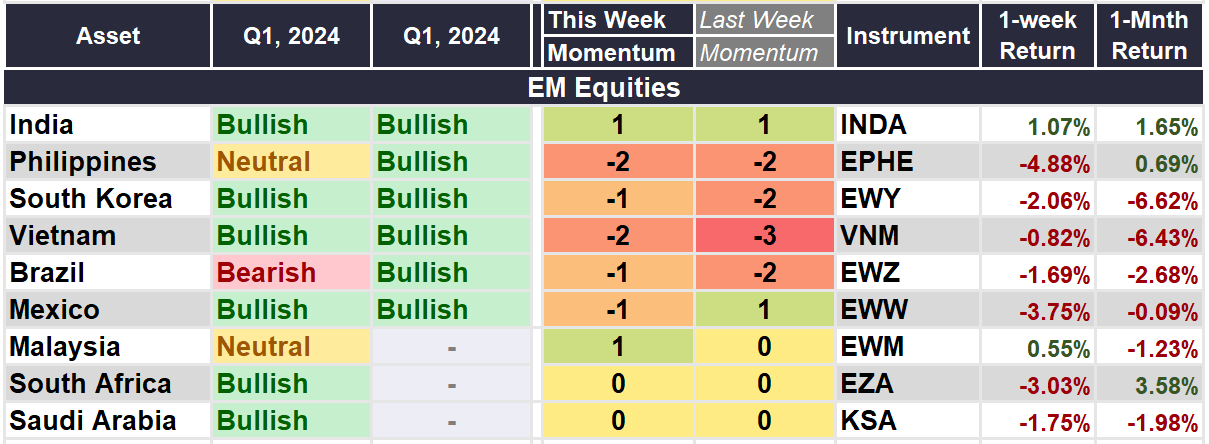

Emerging Markets

We remain cautious and vigilant on equities this week, and currencies due to a stronger dollar. Geopolitical tensions may have taken a pause today but, the situation continues to remain volatile and may impact global market pricing. A stronger USD puts further pressure on EM currencies. This could mean we see inflation pick up even further because of currency weakness, in addition to rising commodity prices, and shortages from weather conditions.

India

Momentum continues to remain bullish. India started their 6-week election process last week on 19 April and will end on 01 June. India has also started earnings season and this is the fourth quarter earnings for most companies because their fiscal year usually ends in March.

Philippines

The Philippines is signaling negative momentum. Equities have taken a turn lower and we continue to see pressure. Even as other Asian markets seem to be trying to recover some ground, the Philippines remains under pressure. The easing cycle has been paused and we’re seeing this weigh on stocks.

South Korea

The Kospi is trying to regain some ground here. We’re starting to see the negative momentum lighten up. GDP growth numbers are expected on Wednesday.

Vietnam

Vietnam is also trying to regain some ground here. We’re starting to see the negative momentum lighten up. Inflation numbers are expected over the weekend.

Brazil

We’re seeing a bit of a bounce in equities. Last week, Brazil’s central bank governor discussed a slowdown in rate cuts because of the current fiscal situation. This could continue to weigh on equities, alongside political issues.

Mexico

Mexico’s equities seem to be stalling here. We may see the rate cut cycle slowing for Mexico as well, although nothing has been discussed explicitly. Mid-month inflation numbers are due this week and that should give us more information.

Malaysia

Momentum has turned positive for Malaysia. Q1 GDP growth rate came in at 3.9% up from 3% and higher than expected.

South Africa

Inflation continues to remain on the high side for South Africa. Headline inflation came in lower but, continues to remain higher than expected. If the Fed continues to keep rates higher for longer, we’re likely to see South Africa push back on rate cuts as well. Currency weakness has kept inflation higher.

Saudi Arabia

While we remain bullish on Saudi equities for the quarter, the proximity to the Middle East geopolitical tensions is causing some pressure on equities in the interim. We may see a bounce this week.

Key 🔑

When we look at momentum drivers, we qualify them on the basis of a score between -3 and +3, with 0 being neutral.

Our model takes into consideration many factors when we calculate momentum on a weekly basis, and the way we built this system is to help update our audience on week-over-week momentum changes.

Macro drivers (varied weightings as appropriate)

Rates

Inflation

GDP growth

LEIs

Liquidity

Gov’t intervention

Earnings

Options structure

Intermarket dynamics

Demand and Supply conditions (for Commodities)

Momentum Drivers

RSI

Volume Profile

Relevant Oscillators (NYMO, NAMO)

Ichimoku cloud

Key moving averages

Sentiment

Flows (futures, ETFs, options)

Positioning (futures, ETFs, options)

RV vs IV

Volatility skew