Regular readers of The Bubble Bubble Report know that, alongside my analysis of precious metals and the financial markets, I regularly include educational insights and practical tips. I also publish dedicated tutorials on trading strategies and market analysis techniques to help my loyal subscribers become more confident and effective traders and investors, no matter which markets they choose to focus on.

I also frequently recommend my favorite books when they’re relevant to the topic at hand. For that reason, today I’d like to share a list of my 15 favorite trading and market analysis-related books. I truly believe that by reading them, you will experience a quantum leap in your understanding of the financial markets. As a result, you will see the markets with much wiser, different eyes. Over the long run, this will help you become significantly more profitable in your investing and trading, while also helping you minimize losses.

Before we begin, I just want to mention that every book on this list is one I have personally read and owned for a long time, with many going back to when I first started learning about financial markets in high school and college. I’m sure there are many excellent trading books out there that I haven’t read yet, but I won’t recommend those until I’ve had the chance to go through them myself. As a voracious reader and bibliophile (i.e., a book lover and collector), I expect this list of favorites will continue to grow over time, and I hope it does. I also own quite a few promising books that I haven’t gotten around to reading yet.

Also, I want to mention that this particular list of books is focused on technical analysis rather than economic, fundamental, or political analysis. I do have other favorite books in those categories as well, and I hope to publish separate lists for them in the future. For today, I’m focusing on technical analysis (i.e., chart and price analysis) so that you can hit the ground running with actionable knowledge that can start producing results quickly.

Next, I also want to preface this by saying that I understand many people in the precious metals community, including many of my subscribers, approach precious metals investing with a long-term, buy-and-hold mindset, as well as a philosophically pro–sound money perspective. I’m aware that teaching trading techniques can sometimes be misunderstood as promoting a “fast money,” rapid-fire trading approach to precious metals. However, I want to assure you that this is not my intention, either with this list of books or with my ongoing tutorials and market analyses.

I too am a long-term precious metals investor and sound money advocate, but I strongly believe that people in our community can seriously benefit from understanding how markets work and what makes them move, even if they choose not to use that knowledge to trade in and out rapidly.

For example, it’s very helpful to know why gold, silver, and mining stocks are rallying or falling, and what they are likely to do in the future, in order to feel more calm and confident in your approach and plan. It is also useful for being able to analyze and interpret the actions of other financial markets that affect precious metals, such as the U.S. dollar, the stock market, interest rates, and the broader commodities market.

I believe the best approach to analyzing markets is a “technamental” one (technical + fundamental), to use the term coined by the first author on this list, John Murphy. However, I actually trust and rely much more on technical or chart analysis than on fundamental analysis, because of my firm belief that fundamentals, news, rumors, analyst expectations, and similar factors are already reflected and discounted in the price and charts. One of my favorite trading adages, “If it’s in the press, it’s in the price,” captures this principle perfectly.

News and fundamental data, when reported, are typically stale and often reflect conditions from months earlier, while price action captures all known and even unreported information in real time, down to the second. I view fundamental analysis as similar to looking in the rearview mirror while driving, whereas technical analysis is like keeping your eyes on the road ahead. There is no way I would have been able to foresee the many twists and turns in precious metals over the past several years using fundamental analysis alone (check out my track record).

That said, I still believe it is important to stay aware of the fundamentals in the interest of being thorough, particularly valuation metrics that indicate whether an asset is undervalued or overvalued, as this helps assess its potential to rise or fall.

So without further ado, here are my favorite books on trading and financial market analysis, listed in the order I recommend reading them. The titles link to each book’s page on Amazon.

This book is often referred to as “the bible of technical analysis.” While several other books share that label, I find this one to be the most readable and user-friendly, yet still extremely comprehensive. It is the first book I recommend to anyone beginning to learn about technical analysis or looking to deepen their understanding.

I first read Technical Analysis of the Financial Markets in high school decades ago (I just turned 40), and I continue to reference and re-read it every few years. Each time, I glean something new. I love it so much that I actually own two copies: one in New York and one in Texas, since I go back and forth between the two states.

This book begins by clearly explaining the core principles of technical analysis, including support, resistance, trendlines, and chart patterns, which I find to be its most valuable section. From there, it moves into a review of the most commonly used technical indicators. While it’s worth being familiar with these indicators, I don’t recommend relying on them too heavily, as they are simply lagging derivatives of price. In my view, it’s far more effective to focus on analyzing price and volume directly.

It’s a common beginner mistake to get caught up in using too many indicators, which often leads to confusion and conflicting signals, resulting in “paralysis by analysis.” In contrast, I recommend a minimalist approach that focuses on support and resistance, trendlines, common chart patterns, and volume. This approach is clearly reflected in the content I produce for The Bubble Bubble Report.

I highly recommend John Murphy’s Technical Analysis of the Financial Markets and believe no trading library should be without it.

After you’ve read Technical Analysis of the Financial Markets, I then recommend Steve Nison’s Japanese Candlestick Charting Techniques, which complements the Western style of technical analysis presented by John Murphy. Candlestick analysis has a long history, dating back to its use by Japanese rice traders in the 18th century, and was first introduced to the Western world by Steve Nison through this best-selling book in 1991.

While Western technical analysis generally focuses more on chart patterns that form over periods of weeks and months as well as technical indicators, Japanese candlestick analysis is much more granular, focusing on information and signals given by individual price bars or clusters of price bars that occur closely together, making it more responsive, precise, and useful for providing short-term signals.

In this book, you’ll discover a range of fascinating and powerful candlestick patterns, many with vivid and memorable names, such as dojis, haramis, tasukis, engulfing patterns, piercing patterns, hammers, hanging men, morning stars, evening stars, shooting stars, dark cloud cover, tweezer tops and bottoms, three black crows, three white soldiers, dumpling tops, and frypan bottoms, to name just a few.

Japanese candlestick analysis also pairs well with Western-style technical analysis to provide the best of both worlds, and Nison is very clear about this in all of his books and other content, showing how to meld the two effectively to create a valuable synergy that is greater than the sum of its parts.

Get this book. Every investor or trader should have this knowledge, and you will never look at the markets the same way again.

After the resounding success of his first book, Japanese Candlestick Charting Techniques, Steven Nison followed up with Beyond Candlesticks in 1994, expanding on the methods and techniques introduced in his original work. I enjoyed his first book so much that buying this second one was an easy decision, and it certainly does not disappoint.

In Beyond Candlesticks, Nison shows many additional real-world examples of candlestick analysis in action and includes more advanced and refined techniques and nuances that he didn’t include in his first book, including additional ways of melding candlestick analysis with Western-style technical analysis such as performing candlestick analysis in conjunction with support and resistance levels, trendlines, chart patterns, and technical indicators.

In this book, Nison also introduces other Japanese charting systems such as renko, kagi, and three-line break charts, which I find intriguing. However, I prefer to stick with candlestick charts, as they are much more versatile and responsive to price action, and I see no reason to use an alternative.

If you’re like me and prefer to be especially thorough when learning something important and valuable, and I believe candlestick analysis is, then I recommend Beyond Candlesticks in addition to Steve Nison’s first book, Japanese Candlestick Charting Techniques.

Once you have a solid handle on candlestick analysis, I highly recommend reading A Complete Guide to Volume Price Analysis by Anna Coulling. It builds on the principles of candlestick analysis and enhances them by teaching you how to analyze trading volume, which adds a valuable extra dimension beyond price. This helps reveal what the “smart money,” meaning institutions, are doing, whether they are positioning themselves early in emerging trends, accumulating shares or contracts, or quietly unloading their holdings.

Although Anna Coulling didn’t discover or invent volume analysis, which has been around for at least a century, she has added more to the body of knowledge on it than anyone else I’ve come across. A Complete Guide to Volume Price Analysis is the most comprehensive book on the topic and is the gold standard for anyone looking to learn about volume analysis.

The topics she covers include using volume to confirm price moves such as breakouts and breakdowns, as well as identifying false moves engineered by market makers or the “smart money” to deceive retail traders. These traps are often intended to shake traders out of their positions and create liquidity, allowing larger players to drive the asset in the opposite direction for their own benefit.

The unfortunate reality is that the markets don’t move in a clean, fair, or straightforward manner, and there is a lot of trickery (as I explained here). But with the knowledge Coulling teaches, you will be well positioned to avoid getting sucked into traps that cause you to lose money, while also being well positioned to get into winning trades by aligning with the smart money.

Coulling also wrote three additional books that are not tutorials like her first one but instead provide detailed examples of how to apply Volume Price Analysis (VPA) to stocks, forex, and cryptocurrencies. However, do not let the specific titles fool you, as the lessons in these books apply to all markets, including precious metals, miners, and commodities. I purchased each one because I’m such a fan of her first book. If you like to be thorough, as I do, I recommend considering these books as well.

The next book I can’t recommend highly enough is Secrets for Profiting in Bull and Bear Markets. I love this one so much that I own two copies, one in New York and one in Texas. That’s how you know it’s indispensable.

The author, Stan Weinstein, published one of the most successful trading newsletters from the 1970s to the 1990s called The Professional Tape Reader. According to a 1983 New York Times article, the newsletter had 15,000 subscribers who paid $250 a year, which is nearly $800 in 2025 dollars, to receive his technical advice twice a month. (Hmm, maybe I’m charging too little…just kidding 😉)

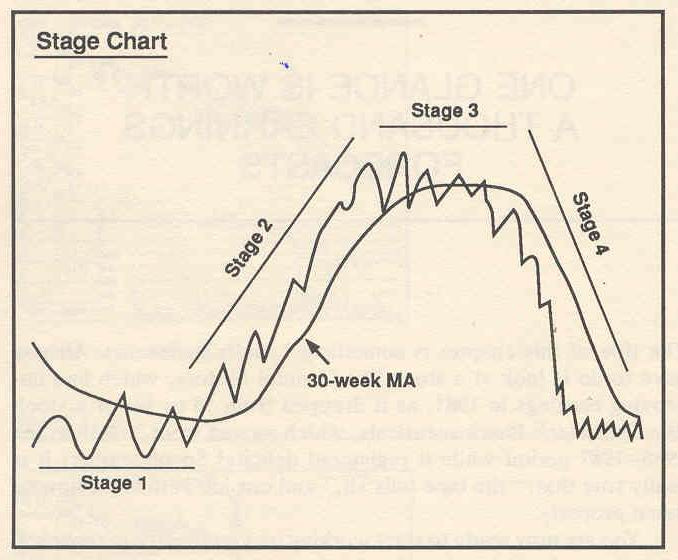

The key methodology Weinstein introduces and develops in Secrets for Profiting in Bull and Bear Markets is called Stage Analysis. This approach, which still has many followers today, involves identifying which of four stages an asset is in: basing, advancing, topping, or declining. These stages are illustrated in the chart below, taken directly from the book.

Once you determine the current stage of an asset, you trade accordingly. This significantly improves your odds of success by focusing on going or staying long only on the strongest assets and exiting or shorting those that are topping out and about to decline. This book and its methodology are especially valuable for mining stock investors or anyone trading precious metals with leverage, as it is crucial to know when to stay in a winning asset for as long as possible and when to get out as the trend changes.

One aspect of Weinstein’s methodology that resonates strongly with me is his focus on the message of price above all else. As he explains in the book, he tunes out news, rumors, and fundamentals, most of which are already priced in or outdated, as I explained earlier. His motto is “The Tape Tells All,” and I agree wholeheartedly.

This technical approach offers a very different way of thinking about and navigating the markets compared to the mainstream fundamental approach, which attempts to predict future performance based on economic data, earnings reports, and news. Although that may seem logical and grounded in common sense, it rarely works in practice and is almost entirely ineffective at predicting most price movements, including major rallies and sharp declines.

To support this point, Weinstein explains that stocks often top out when news and earnings reports are at their best, while they tend to bottom when news and earnings reports are at their worst. I have personally observed this phenomenon many times firsthand, not only in stocks but across all markets, including commodities. In fact, this is more often the rule rather than the exception, and fundamentalists who ignore technical analysis are effectively flying blind.

In short, Secrets for Profiting in Bull and Bear Markets is essential reading for all investors and traders, regardless of the asset class they focus on.

The next book, How I Made $2,000,000 in the Stock Market by Nicholas Darvas, is an oldie but a goodie. It uses a similar, though more basic, methodology to that of Stan Weinstein. Traders who appreciate this style of approach, including myself, often hold both books and authors in very high regard.

Nicholas Darvas (1920–1977) was born in Hungary and trained as an economist at the University of Budapest. He later moved to the United States, where he built a successful career as a ballroom dancer that took him around the world. Determined to learn how to invest, he read over 200 books on the subject before getting started. However, his early results were disappointing, as he initially relied on stock tips, broker recommendations, rumors, and news.

Things finally clicked for him as an investor when he learned to tune out all of the noise and focus solely on what a stock’s price and volume were telling him, as that reflected all information, both known and unreported. He used this methodology to grow his initial $10,000 into $2,000,000 over a period of just 18 months during the late 1950s, which is an impressive $22 million in 2025 dollars.

Darvas’s methodology is called “box theory” because it involves identifying stocks that are consolidating within a sideways range, which can be visualized as a box-like structure. He would buy these stocks when they broke out of the box with strong volume, indicating that smart money was behind the move. This made the breakout far more likely to succeed rather than turn into a false move.

This book is engaging, inspiring, and a fairly quick read. It’s not overly technical, and I recently re-read it during a weekend at the beach this past summer. Although Darvas focused solely on stocks in both his investing and in this book, the principles he discusses apply to virtually all types of assets, including precious metals and commodities, and are particularly helpful for mining stock investors.

Another of my favorite books is William J. O’Neil’s How to Make Money in Stocks, which was first published in 1988 and has gone through several updated editions, with the most recent being the fourth edition published in 2009. The methodology in this book aligns closely with Stan Weinstein’s Secrets for Profiting in Bull and Bear Markets and Nicholas Darvas’s How I Made $2,000,000 in the Stock Market, while also offering many unique and valuable insights and techniques of its own.

William J. O’Neil was a stockbroker, investor, and entrepreneur who founded Investor’s Business Daily (IBD), a newspaper designed to be a more technically focused alternative to The Wall Street Journal. Unlike traditional financial publications, IBD features charts, breakout lists, and proprietary metrics that reflect O’Neil’s unique investing methodology.

To develop this approach, O’Neil built a comprehensive database of winning stocks dating back to the early 1900s and analyzed the traits they shared before their major price advances. That research became the foundation of the CAN SLIM® system, which he teaches in How to Make Money in Stocks.

The CAN SLIM system is a growth investing strategy that combines technical and fundamental analysis to identify stocks with strong potential before they make major moves. The acronym stands for Current quarterly earnings, Annual earnings growth, New products, services, or price highs, Supply and demand (favoring stocks with limited supply and strong volume), Leader or laggard (favoring industry leaders), Institutional sponsorship, and Market direction.

By focusing on stocks that meet all seven criteria, investors can significantly increase their odds of selecting high-performing stocks while managing risk by aligning with the broader market trend.

Although the book focuses on stocks, its technical analysis principles are excellent and apply to virtually every type of asset. It is a must-read for mining stock investors, and interestingly, gold and silver mining stocks currently rank among the top CAN SLIM candidates on Investor’s Business Daily, which I subscribe to and have read for over two decades.

I strongly believe in the CAN SLIM methodology taught in How to Make Money in Stocks and Investor’s Business Daily, having seen it identify numerous successful stocks and accurately anticipate broad market moves firsthand. That’s why I highly recommend reading this book.

The next book, 24 Essential Lessons for Investment Success, was also written by William J. O’Neil and is essentially a simplified version of How to Make Money in Stocks. It was actually my first introduction to Investor’s Business Daily and the CAN SLIM approach, which really opened my eyes, so it holds some nostalgic value for me. Although simplified, I still appreciate and recommend this book because it reinforces the core principles of the methodology and is a relatively quick and enjoyable read.

Another excellent book by William J. O’Neil is How to Make Money Selling Stocks Short, which takes the same CAN SLIM principles used to identify winning stocks and applies them in reverse to find stocks that are topping out and about to break down sharply. This creates potentially lucrative opportunities to profit on the short side.

Even if you have no intention of short-selling stocks or any other asset, this book is still valuable because it teaches you how to recognize when an asset is transitioning from an uptrend to a sideways phase and eventually into a downtrend.

This knowledge can help you identify when it’s time to exit positions that are likely to decline, giving you an early warning to protect your capital. In many ways, the principles in this book complement those taught by Stan Weinstein in Secrets for Profiting in Bull and Bear Markets.

Now let’s turn to a book that covers another type of analysis that is highly useful for precious metals and commodities investors: Intermarket Analysis by John Murphy, who also authored the first book on this list, Technical Analysis of the Financial Markets.

Intermarket analysis is a form of technical analysis that examines the relationships and correlations between different asset classes to help anticipate movements in other assets and markets.

In Intermarket Analysis, John Murphy highlights several well-established relationships, such as the inverse correlation between the U.S. dollar and commodities (including precious metals). For example, moves in the dollar often occur first and are followed by corresponding moves in commodities. He also explains how bonds tend to lead the stock market at both tops and bottoms, and how commodities frequently lead bonds by signaling shifts in inflation expectations.

I make heavy use of intermarket analysis in my own investing and in this newsletter (see this example), so this is an essential read, and I promise you won’t be disappointed.

All investors and traders (not just commodities traders) should read How I Made $1,000,000 Trading Commodities Last Year by Larry Williams, who became famous for winning the Robbins World Cup Trading Championship in 1987 by turning $10,000 into over $1.1 million in just 12 months, a verified and audited achievement.

As if that weren’t impressive enough, he also taught his daughter, actress Michelle Williams, how to trade. At just 17 years old, she entered and won the Robbins World Cup Championship, turning an initial $10,000 into about $100,000, a 900% return, making her the third-highest recorded winner in the competition’s history. I think that speaks for itself as to why this book is worth reading.

Williams covers a wide range of topics in this book, including the importance of trading with the trend rather than against it, the role of volume and his principle that volume precedes price, the use of Commitment of Traders (COT) data to track the smart money’s moves in commodities, awareness of seasonality in commodity markets, the importance of market cycles, trading psychology, and risk management.

I should note that, although not covered in great depth compared to his later work, this book introduces some of Larry Williams’ original concepts, including the Williams %R indicator. This momentum oscillator is used to identify overbought and oversold conditions, and it’s one of the few technical indicators I actually use and believe in—the others being the 200-day moving average and, occasionally, the Relative Strength Index (RSI) and Bollinger Bands.

You can see how I apply Williams %R in my tutorial on identifying when to buy dips and sell rips. I also used it quite successfully to predict the recent rebound and rally in precious metals and mining stocks on November 5th.

As I’ve mentioned before, I’m not usually someone who relies heavily on technical indicators, but I still consider Bollinger on Bollinger Bands one of my favorite books—and with good reason. Written by John Bollinger, the creator of the Bollinger Bands indicator, the book offers a thorough explanation of this widely used tool, which is designed to measure asset price volatility and identify overbought or oversold conditions.

What I found most valuable in this book, and the main way I use Bollinger Bands, is for analyzing price volatility, particularly identifying volatility squeezes that often lead to sharp breakouts. I applied this approach very successfully this past summer to spot the big fall rallies in gold as well as copper and silver.

Unlike most books on technical indicators, this one provided insights that genuinely changed the way I look at markets. That is why I feel confident recommending it to you.

Now I’ll move on to books that don’t teach specific trading or market analysis techniques, but are still well worth reading because they are inspiring, entertaining, and offer valuable insight into how successful traders and market analysts think and operate. The first of these is the famous Market Wizards by Jack Schwager.

Market Wizards features in-depth interviews with some of the most successful traders of the 20th century, offering rare insight into their strategies, mindsets, risk management principles, and personal journeys. It includes adrenaline-inducing stories of remarkable trading wins, as well as gut-wrenching accounts of devastating losses.

Notable traders interviewed include Paul Tudor Jones, Marty Schwartz, Bruce Kovner, Ed Seykota, Jim Rogers, Michael Marcus, and Richard Dennis, a legendary commodities trader who turned a small stake into $200 million and demonstrated that successful trading could be taught to virtually anyone through his famous Turtle Traders experiment.

I fell in love with this book and with the financial markets when I first read it in high school. Since then, I’ve purchased and read the other books in the series, including The New Market Wizards, Stock Market Wizards, Hedge Fund Market Wizards, and Unknown Market Wizards, and I plan to buy the upcoming Market Wizards: The Next Generation when it’s released in 2026.

I highly recommend reading Market Wizards, and if you’re anything like me, you’ll find it hard to put down.

The next book, Pit Bull, is written by Martin “Buzzy” Schwartz, one of the most successful short-term traders in Wall Street history and a featured interviewee in the original Market Wizards. He primarily traded stock index futures, especially the S&P 500, which at the time were traded in the open-outcry pits in Chicago rather than electronically as they are now.

The book includes many fascinating anecdotes from that intense and colorful era—an era that, unfortunately, ended just as I was graduating college in 2008. I had originally hoped to find employment in the NYMEX (New York Mercantile Exchange) futures and options trading pits (in some form or another), but by then they were transitioning to electronic trading, and the 2008 financial crisis sealed the fate of that career path.

Known for turning a small trading account into millions and for winning the U.S. Investing Championship in 1984, Schwartz blends personal storytelling, trading insights, and hard-earned lessons from the front lines of the financial markets.

One anecdote from this book that I personally love and strongly relate to is Schwartz’s account of the 1987 stock market crash. He describes how, in the midst of the panic, his first instinct was to buy gold in case the situation escalated into a broader financial crisis like 1929, and then to return home to make sure his wife and children were safe.

Pit Bull is a relatively quick and enjoyable read, and it isn’t technical or dry. The writing flows well, and I think you will enjoy it.

The final book on this list is perhaps the most famous trading book of all time: Reminiscences of a Stock Operator by Edwin Lefèvre. It is a semi-autobiographical novel based on the life of legendary trader Jesse Livermore, one of the most iconic speculators in Wall Street history. No list of trading books would be complete without it.

Although Reminiscences of a Stock Operator is over a century old and doesn’t offer many tactical techniques you can apply immediately, it teaches worthwhile principles on trading psychology, speculation, market cycles, and risk management. The book also holds significant historical value and is frequently quoted in the world of trading and finance. For that reason alone, I believe anyone interested in trading should read it to be familiar with the foundational ideas and history that continue to influence market thinking today.

So that concludes the list of my 15 favorite trading books, ranked in order of importance. I realize it’s a fairly extensive list, and I don’t want you to feel overwhelmed or daunted. If this learning journey is important to you, I recommend simply starting with the first couple of books. They’re substantial on their own, and by focusing on learning them deeply, you’ll gain incredibly valuable insights that will set you on a solid path. And as I always strive to do in The Bubble Bubble Report, I’ll continue sharing valuable knowledge in straightforward, accessible terms so that people from all walks of life can understand it.

I hope you enjoyed this list of books, and I’d love to hear your feedback in the comments section below. Let me know if you’ve read any of these titles, what you thought of them, and if there are other books you’d recommend.

I also recommend checking out the tutorials I’ve written over the past year, which incorporate many of the techniques I’ve learned from these books, along with ones I’ve discovered or developed myself:

- Support & Resistance Zones Explained – Part 1

- Support & Resistance Zones Explained – Part 2

- A Simple Yet Powerful Technique for Identifying Trends

- When to Buy Dips and Sell Rips

- How to Confirm Breakouts Using Volume