Investing Ideas

Every month we publish our take on stocks as investing ideas. The holding period for these ideas may range from 3 weeks to 3 years, although we prefer more strategic ideas with a 2-3 year time frame.

The ideas are based on Macro or Thematic catalysts, and we use fundamental or technical analysis to firm up our view, sometimes both! We attempt to create a diversified portfolio of ideas that can have a runway of growth.

While we publish weekly price updates on our list of ideas on our Weekly Dashboard, you can scroll to the bottom of the page to view our list which is updated once a month.

To give you an idea… two of our best-performing ideas as of 29 Feb 2024 have been:

Blue Owl Capital (OWL) +49.67%

Nintendo (NTDOY) +34.14%

The MacroVisor Long-Term Portfolio

We’re launching a list of stocks as part of our long-term portfolio. We’re choosing these stocks based on three basic criteria:

Quality – Solid fundamentals, capital allocation decisions, and financial management

Relevance – How relevant the company is will determine how well this company will grow and continue to remain in business

Longevity – Do the companies have staying power or the power to innovate and pivot when times change

We’re looking at a time horizon of 10-30 years, so basically solid companies that we can put away into our portfolios for retirement.

Long-Term Portfolio

1) McDonald’s – (MCD) – The low-cost franchise model is something we see as sustainable, particularly in a tough environment.

2) Visa – (V) – One of two major payment processors. We go with Visa instead of MasterCard because they have a better asset allocation strategy.

3) Apple – (AAPL) – Dominating force in hardware. Streaming services could become a major tailwind.

4) Qualys – (QLYS) – Cloud-based Cybersecurity company with solid fundamentals serving Fortune 500 companies. Over 10,000 customers worldwide.

5) Exxon – (XOM) – Integrated oil now with the largest exposure in the Permian Basin and assets in Guyana.

6) Enphase – (ENPH) Exposure to solar in the US and Europe, particularly from a retail point of view. Despite the pullback and current tough environment, we see a future for this company.

7) Rockwell Automation – (ROK) – Brings automation to industrial companies. Operating since 1906 and is consistently innovating.

8) Accenture – (ACN) – Consulting for technology. Helps major companies implement technology and advises on improving operations.

9) Microsoft – (MSFT) – Software and now Cloud. Hardware is a laggard for them.

10) Scientific Applications International Corporation – (SAIC) – A beneficiary from the long-term digital transformation of government agencies

11) CACI International Inc – (CACI) – Key catalysts include aerospace and defense cybersecurity and IT spending growth

12) Vietnam – (VNM) – Re-shoring, an emerging middle class, and increasing foreign investment amid de-regulation of financial markets all spell a promising investment opportunity in the country.

How to buy?

We’re looking at dollar cost averaging for these names. Given that our idea is to accumulate these names over a long time period, we’d be looking to “buy the dips” and lower our average cost every time we see these companies sell-off.

These are just a set of ideas and we plan to add more names to the list as time goes on. We will also do deep dives on the more unfamiliar names, to begin with, but, these posts will be done gradually with one post every two to three months. Once we’re done with the post, we’ll link them to the name on this static page so you can always check back on them.

Disclaimer: You can choose to pursue an idea once we have completed the deep dive on them.

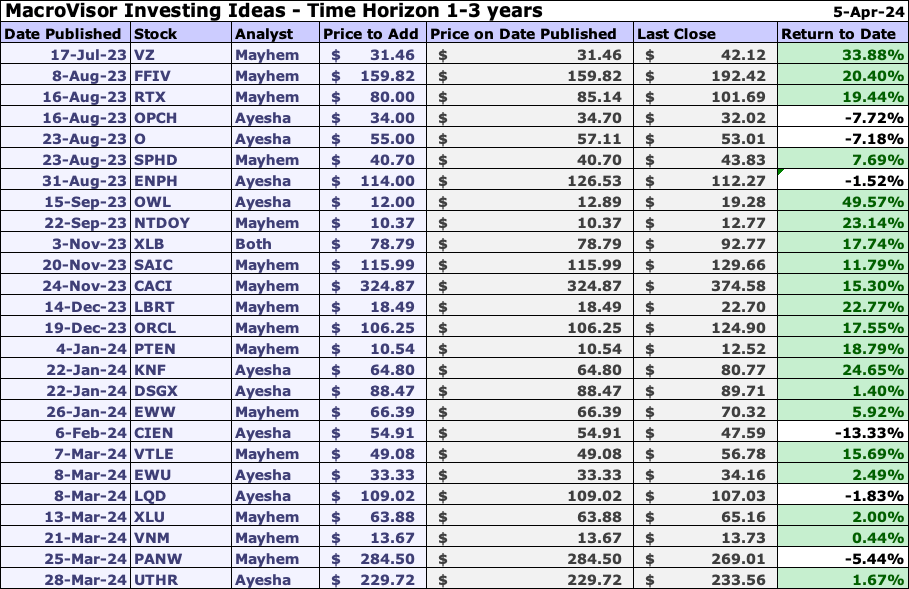

Investing Ideas Scorecard as of 05 April 2024